Proposed cancellation of admission of Common Shares to trading on AIM; Proposed Stockholder approval of Exclusive License and Distribution Agreement And Notice of Special Meeting

LungLife AI (AIM: LLAI), a developer of clinical diagnostic solutions for lung cancer, announces that, further to its previous announcements, the Company will shortly send a circular to Stockholders (the "Circular"), which contains a notice of Special Meeting of Stockholders (the “Special Meeting”) and resolutions (the “Resolutions”) in connection with the proposed cancellation of admission of the Company’s Common Shares to trading on AIM and also to seek the Stockholder approval that is required to allow for Completion of the Company’s Exclusive License and Distribution Agreement (the “Agreement”) with Circulogene Theranostics, Inc. (the “Proposals”).

The purpose of the Circular is to provide information on the background to and reasons for the proposed Cancellation and to explain the consequences of the Cancellation. The purpose of the Circular is also to provide information on the background and reasons for entering into the Agreement; to explain the consequences of the Agreement; and to provide reasons why the Directors unanimously consider both of the Resolutions to be in the best interests of the Company and its Stockholders as a whole and recommend that the Stockholders approve the same.

The Special Meeting is to be convened for 4:00 p.m. UK time on 20 May 2025 at the offices of Allenby Capital Limited at 5th Floor, 5 St Helen's Place, London EC3A 6AB.

Pursuant to Rule 41 of the AIM Rules, the Company through its AIM nominated adviser, Allenby Capital Limited, has notified the London Stock Exchange of the date of the proposed Cancellation which is expected to become effective at 7.00 a.m. on 29 May 2025 if the Cancellation Resolution is passed at the Special Meeting.

Availability of Circular

The Circular will be sent to Stockholders today, 29 April 2025. A copy of this announcement and the Circular will be made available shortly on the Investors section of the Company's website at https://lunglifeai.com/investors/.

Extracts from the Circular are set out, without material amendment, below.

The above summary should be read in conjunction with the full text of this announcement and the Circular, extracts from which are set out in the Appendices below. All capitalised terms used throughout this announcement shall have the meanings given to such terms in the Definitions section in Appendix 3 to this announcement below and as defined in the Circular. References to 'this Document' refer to the Circular. References to numbered 'Parts' below refer to the relevant parts of the Circular.

Unless otherwise defined herein, the capitalised defined terms used in this announcement have the same meaning as those used in the Circular.

For further information please contact:

| LungLife AI, Inc. Paul Pagano, CEO David Anderson, CFO | www.lunglifeai.com via investors@lunglifeai.com |

| Allenby Capital Limited Nominated Adviser and Joint Broker Alex Brearley / Lauren Wright - Corporate Finance Matt Butlin / Guy McDougall - Equity Sales & Corporate Broking | Tel: +44 (0)20 3328 5656 info@allenbycapital.com |

| Goodbody (Joint Broker) Tom Nicholson / Cameron Duncan | Tel: +44 (0) 20 3841 6202 |

About LungLife

LungLife AI is a developer of clinical diagnostic solutions designed to make a significant impact in the early detection of lung cancer, the deadliest cancer globally. Using a minimally invasive blood draw, the Company's LungLB® test is designed to deliver additional information to clinicians who are evaluating indeterminate lung nodules. For more information visit www.lunglifeai.com.

Our Purpose is to be a driving force in the early detection to lung cancer. And our Vision is to invert the 20:80 ratio such that in years to come at least 80% of lung cancer is detected early.

APPENDIX 1: EXTRACTS FROM THE CIRCULAR

PART I - LETTER FROM THE CHAIR

LUNGLIFE AI, INC.

(incorporated in the State of Delaware, USA under the Delaware General Corporation Law with registered file number 4771503)

| Directors: Gordon Roy Davis Paul Pagano David Anderson Andrew Norman Boteler Sara Jane Barrington | Registered office: 850 New Burton Road Suite 201, Dover Delaware 19904 USA |

29 April 2025

Dear Stockholder

PROPOSED CANCELLATION OF ADMISSION OF THE COMMON SHARES TO TRADING ON AIM

APPROVAL OF EXCLUSIVE LICENSE AND DISTRIBUTION AGREEMENT WITH CIRCULOGENE THERANOSTICS, INC.

AND

NOTICE OF SPECIAL MEETING

1. Introduction

On 3 February 2025, the Company announced that the Board intended to seek Stockholder approval for the voluntary cancellation of admission of the Common Shares to trading on AIM (the “Cancellation”). On 29 April 2025, the Company announced that it is seeking Stockholder approval for the Cancellation at the Special Meeting, which has been convened for 4.00 p.m. UK time on 20 May 2025 at the offices of Allenby Capital Limited, 5 St Helen’s Place, London EC3A 6AB.

On 17 April 2025, the Company also announced that it had entered into an Exclusive License and Distribution Agreement with Circulogene Theranostics, Inc (“Circulogene”) (the “Agreement”), a US-based comprehensive liquid biopsy diagnostics company, pursuant to which, if approved by Stockholders and certain other approvals are obtained, inter alia, the Company will receive total advanced payments of $750,000, guaranteed minimum royalty payments of $450,000 and gives an Asset Purchase Option to acquire the LungLB test and related assets for $6,200,000 less payments received by the later of 30 September 2025 or 60 days after Completion (as defined below) of the Agreement.

Completion of the Agreement also requires, among other things, obtaining Stockholder approval to approve the Agreement, which the Company is seeking via the Agreement Approval Resolution. Further details of the Agreement can be found in section 2 of this Part I, below.

If the Cancellation Resolution is passed at the Special Meeting, it is anticipated that the Cancellation will become effective at 7.00 a.m. on 29 May 2025. The Cancellation Resolution is conditional, pursuant to Rule 41 of the AIM Rules, upon the approval of not less than 75 per cent. of the votes cast (whether by Stockholders present in person or by proxy) at the Special Meeting.

In accordance with Rule 41 of the AIM Rules, the Company has notified the London Stock Exchange of the date of the proposed Cancellation, which, subject to Stockholder approval of the Cancellation Resolution, is expected to become effective at 7.00 a.m. on 29 May 2025.

Accordingly, the Board is seeking Stockholder approval for the Cancellation and the Agreement. Further details are set out below.

The purpose of this Document is to provide information on the background to and reasons for the proposed Cancellation; to explain the consequences of the Cancellation; and provide reasons why the Directors unanimously consider the Resolutions to be in the best interests of the Company and its Stockholders as a whole. The purpose of this Document is also to provide information on the background and reasons for entering into the Agreement; to explain the consequences of the Agreement; and provide reasons why the Directors unanimously consider both the Cancellation Resolution and the Agreement Approval Resolution to be in the best interests of the Company and its Stockholders as a whole and recommend that the Stockholders approve the same.

The Notice of the Special Meeting is set out on page 14 of this Document.

2. Background to and reasons for the proposed Resolutions

The Common Shares have been admitted to trading on AIM since the Company’s initial public offering in July 2021. Since the Company’s initial public offering, and subsequent fundraise in March 2024, LungLife has been able to use the funds to advance its LungLB® test, including the successful clinical validation of LungLB® following conclusion of the multi-site validation trial in 2024.

On 3 February 2025, the Company provided an operational and funding update (the “February 2025 Update”), which noted, among other things, that it had become clear to the Board that the most appropriate course of action would be for the Board to seek approval from the Stockholders of the Company to cancel the admission of the Company's Common Shares to trading on AIM in accordance with Rule 41 of the AIM Rules for Companies.

In the February 2025 Update, the Company also stated that the Board proposed to continue to consider potential sources of funding options for the Company but, should none be identified, nor any strategic agreement reached, the Board anticipated the orderly winding up of the business in due course.

On 17 April 2025, the Company announced that Circulogene had continued to perform diligence relating to payor and payment processes and following that due diligence has re-engaged with LungLife in relation to the commercial licencing of the Company’s LungLB® test, which has led to the Company entering into the Agreement.

Licensing Terms

As announced on 17 April 2025, under the Agreement, an advanced payment of $375,000 has been paid to LungLife by Circulogene following signature (the “Advanced Payment”). If LungLife fails to obtain the required consents to allow for completion of the Agreement (“Completion”), including but not limited to, obtaining Stockholder approval and obtaining certain other consents under the Agreement (the “Required Consents”), then LungLife will be required to return the Advanced Payment within thirty days following termination of the Agreement. The Advanced Payment is made pursuant to a promissory note (the “Promissory Note”) provided by LungLife that is secured by certain of LungLife's physical assets.

In order to progress Completion of the Agreement, the Company is seeking Stockholder approval to approve the Agreement, via the Agreement Approval Resolution. As at the date of this Document the Company is working with the relevant stakeholders in order to satisfy the Required Consents.

Following Completion of the Agreement, a further payment of $375,000 is to be received by LungLife and the liability under the Promissory Note, including the security interest in certain of LungLife's physical assets, falls away. From Completion, Circulogene will have the exclusive right and license to improve, further develop, utilise, practice, market, distribute, offer for sale, sell and otherwise commercialise the LungLB® test along with all software and intellectual property which is licensed by the Company in the United States and its territories, along with, among other things, certain of the Company’s equipment which shall be transferred to Circulogene. The Company will work with Circulogene to allow for Circulogene to be able to provide the LungLB® test from its own laboratory as contemplated under the Agreement by 31 August 2025.

LungLife will receive royalty payments equivalent of twenty per cent of the net revenue collected by Circulogene in relation to the LungLB® test for the first year of the Agreement, but with guaranteed minimum royalty payments covering the first three quarters of this year of $450,000, provided that, if the actual royalty payments earned in that period equate to less than $450,000, the shortfall will be offset against future royalty payments due under the Agreement. Following the one year anniversary of the signing of the Agreement, the royalty percentage shall automatically be reduced from twenty per cent. to fifteen per cent.

The initial term of the Agreement is for a period of two years from Completion, after which there is the ability to renew in successive periods for one year, upon the mutual agreement of LungLife and Circulogene, for a maximum of five renewal terms. The initial term is subject to a potential increase to 10 years from Completion in certain circumstances described below.

The Agreement may be terminated by either LungLife or Circulogene in various circumstances, including if the Required Consents, including but not limited to Stockholder approval to approve the Agreement or to allow for the exercise of the Agreement’s asset purchase option (the “Asset Purchase Option”, as described below), are not met within certain specified timeframes.

Asset Purchase Option Terms

In addition to the terms above, from Completion, the Agreement also contains the Asset Purchase Option, whereby Circulogene has the option but not an obligation, by the later of 30 September 2025 or sixty (60) days after Completion (the "Option Window"), to acquire the licensed IP, the leased equipment and all other applicable licenses for a consideration of $6,200,000, less all payments received by LungLife referred to above, but subject to and conditional on, among other things, Stockholder approval of a purchase agreement at the time of exercise and potentially the consent of the Company's Stockholders being given in a meeting pursuant to Rule 15 of the AIM Rules for Companies (as this may be applicable).

Should the Asset Purchase Option be exercised, the Board currently expects that the Company would make a distribution to Stockholders of a portion of the proceeds receivable by LungLife, with the remainder to be used fund the operations of the Company.

If Circulogene exercises the Asset Purchase Option but the transaction is unable to be consummated due to circumstances of LungLife or circumstances outside the reasonable control of Circulogene, such as LungLife's failure to obtain the required Stockholder consent or its breach of the Agreement, then Circulogene has the option to either terminate the Agreement or extend the initial term of the Agreement for a period of ten (10) years from Completion. In that circumstance, the royalty payments would be reduced to ten percent of the net revenue collected by Circulogene in relation to the LungLB® test for the remainder of the term.

Right of First Refusal

If, during the term of the Agreement, LungLife receives an offer to purchase a controlling interest in the Company, to purchase the LungLB® test or related assets, or to exclusively license the LungLB® test outside of the United States and its territories, then, during a certain election period following such offer, Circulogene will have a right of first refusal to itself consummate the proposed transaction on the offered terms or, if LungLife receives the offer within the Option Window, to effectuate the Asset Purchase Option (i.e., purchase the licensed IP, the leased equipment and all other applicable licenses for a consideration of $6,200,000, less all payments received by LungLife referred to above), but subject to and conditional on, among other things, Stockholder approval of a purchase agreement at the time of exercise and potentially the consent of the Company's Stockholders being given in a meeting pursuant to Rule 15 of the AIM Rules for Companies (as this may be applicable).

The Company has not capitalised the research and development expenditure associated with the creation of the LungLB® test and the LungLB® test is therefore recorded as having nil carrying value in the Company’s statement of financial position. The Company’s unaudited statement of financial position as at 30 June 2024, announced in the Company’s half-year report on 22 August 2024, carried an intangible asset value of $5.8 million in relation to a license to access certain de-identified patient records at the Mount Sinai Hospital, which does not form part of the Agreement and will not be subject to the Asset Purchase Option. Approximately $0.5 million of unaudited losses were attributable to the LungLB® test over the year ended 31 December 2024, being the research and development expenditure over that period.

Promissory Note

The Advanced Payment of $375,000 was made pursuant to a Promissory Note under which interest of 7.5% is payable and the amount is secured by a lien in certain tangible assets of the Company. In the event Completion takes place the amount of $375,000 is no longer repayable and the liability under the Promissory Note, including the security interest in certain of LungLife's physical assets, falls away.

About Circulogene

Founded over a decade ago, Circulogene is a US-based liquid biopsy diagnostics company. With multiple clinical laboratories and an extensive testing menu, it supports precision medicine initiatives for patients at risk of cancer and those diagnosed with cancer using proprietary methodologies for tumour analysis, ensuring accurate and timely cancer treatment. As part of a conglomerate of healthcare entities, Circulogene benefits from comprehensive support across the healthcare continuum, including sales, marketing, and revenue cycle management (billing).

Copies of the Agreement and the documents delivered or deliverable thereunder including the Promissory Note and Security Agreement can be requested by Stockholders by emailing: investors@lunglifeai.com.

Operational Update

Since the February 2025 Update, given the constraints of the Company’s cash position and obligations, as outlined in the February 2025 Update, the Company undertook various cost reductions that were envisaged at the time of the February 2025 Update.

On 31 March 2025 the Company had an unaudited cash balance of approximately $850,000 and since the beginning of February 2025 has taken action to reduce expenditure, including the termination of six members of staff. The Agreement will require the re-hiring of a minority of these members of staff, and it is anticipated that the Company’s existing cash balances combined with the minimum funding under the Agreement following Completion will satisfy the Company’s funding needs into 2026.

Should the Agreement Approval Resolution not be approved by Stockholders, or if any of the other Required Consents are not satisfied or if the Agreement were to be terminated, then the Company would be obligated to repay the Advanced Payment pursuant to the Promissory Note, and under these circumstances in the absence of additional financing the Board currently anticipates that the Company would only be able to manage its cash resources to provide a cash runway into Q3 2025, and accordingly in such circumstances the Board would likely revert to a strategy of winding up the Company’s business. Accordingly, the Board considers, among other things, that it is important for Stockholders to vote in favour of Agreement Approval Resolution at the Special Meeting to allow for the proposals under the Agreement to proceed.

Further to the Company’s previous announcements, the Company submitted its application to the relevant Medicare contractor for the technical assessment of LungLB® in Q1 this year.

Proposed Cancellation

Following the Agreement, LungLife is expected to have a limited level of operating activity, with the Company’s activities in the medium-term being expected to principally involve running the LungLB® test and the collection of royalties. Accordingly, the Board believes that LungLife will be best placed as a private company to pursue this and still considers that the most appropriate course of action is for the Company to propose to seek approval from the Stockholders of the Company to cancel the admission of the Company's common shares to trading on AIM in accordance with Rule 41 of the AIM Rules for Companies (the “Cancellation”).

The Board has assessed that the considerable cost of maintaining admission to trading on AIM, including fees payable to its professional advisers, including the nominated adviser and brokers, AIM fees payable to the London Stock Exchange as well as the incremental legal, insurance, accounting and auditing fees, along with the considerable amount of management time associated with maintaining the Company’s admission to trading on AIM are, in the Directors’ opinion, disproportionate to the benefits to the Company given how Lunglife’s operations are likely to proceed under the Agreement.

Following extensive consideration, the Board has unanimously concluded that the proposed Cancellation and the Agreement are in the best interests of the Company and its Stockholders as a whole.

3. Process for, and principal effects of, Cancellation

Stockholders who wish to remain Stockholders of LungLife following Cancellation are welcome to do so. However, the Directors are aware that certain Stockholders may be unable, or unwilling, to hold Common Shares in a private company in the event that the Cancellation is approved and becomes effective. Such Stockholders should consider selling their Common Shares in the market prior to the Cancellation becoming effective, as the shares will be largely illiquid if LungLife is private.

As a private company, there will be no formal market mechanism enabling Stockholders to trade in the Common Shares and the Common Shares (a) will be subject to trade restrictions imposed by US securities laws, and (b) may not be sold, transferred, assigned, pledged, or hypothecated unless an exemption from registration under US securities laws exists, as determined by LungLife, and which may require the holder to deliver to the Company an opinion of counsel regarding the same that is reasonably acceptable to the Company.

It is emphasised that there can be no guarantee that Stockholders will be able to buy or sell Common Shares following Cancellation. Given that there will be no market facility platform in place after Cancellation, Stockholders should be aware of the risks of remaining Stockholders of LungLife following Cancellation.

The Board is not making any recommendation as to whether or not Stockholders should buy or sell their Common Shares.

Rule 41 of the AIM Rules requires any AIM company that wishes the London Stock Exchange to cancel the admission of its shares to trading on AIM to notify stockholders and to separately inform the London Stock Exchange of its preferred cancellation date at least 20 clear Business Days prior to such date.

In accordance with AIM Rule 41, the Directors have notified the London Stock Exchange of the Company’s intention to cancel the Company’s admission of its Ordinary Shares to trading on AIM on 29 May 2025, subject to the Cancellation Resolution being passed at the Special Meeting. Accordingly, if the Cancellation Resolution is passed at the Special Meeting, the Cancellation will become effective at 7.00 a.m. on 29 May 2025.

If the Cancellation becomes effective, Allenby Capital will cease to be the nominated adviser of the Company pursuant to the AIM Rules and the Company will no longer be required to comply with the AIM Rules.

Under the AIM Rules, it is a requirement that the Cancellation must be approved via a general resolution by not less than 75 per cent. of votes cast (by proxy or in person) at the Special Meeting. Accordingly, the Notice of Special Meeting set out at the end of this Document contains the Cancellation Resolution.

The principal effects of the Cancellation will include the following:

- as a private company, there will be no formal market mechanism enabling Stockholders to trade in the Common Shares and the Common Shares (a) will be subject to trade restrictions imposed by US securities laws, and (b) may not be sold, transferred, assigned, pledged, or hypothecated unless an exemption from registration under US securities laws exists, as determined by LungLife, and which may require the holder to deliver to the Company an opinion of counsel regarding the same that is reasonably acceptable to the Company;

- there will be no formal market quote or live pricing for the Common Shares, therefore it will be more difficult to sell Common Shares or for Stockholders to determine the market value of their investment in the Company, compared to shares of companies admitted to trading on AIM (or any other recognised market or trading exchange);

- it is possible that immediately following the publication of this Document, the liquidity and marketability of the Common Shares may be significantly reduced and their value adversely affected (although the Directors believe that the liquidity in the Common Shares is currently, and has for some time, been in any event, limited);

- the regulatory and financial reporting regime applicable to companies whose shares are admitted to trading on AIM will no longer apply;

- following the Cancellation, it is anticipated that the majority of the Directors will step down and there may only be two Directors on the Board;

Stockholders will no longer be afforded the protections given by the AIM Rules, such as the requirement to appoint an AIM nominated adviser or the requirement for Stockholders to be notified of price sensitive information or certain events and the requirement that the Company seek Stockholder approval for certain corporate actions, where applicable, including substantial transactions, reverse takeovers, related party transactions and fundamental changes in the Company’s business, including certain types of acquisitions and disposals;

the levels of disclosure and corporate governance within the Company will not be as stringent as for a company quoted on AIM. However, the Company intends to continue to communicate information to Stockholders, including via updates on the Company’s website;

- the Company will no longer be subject to UK MAR regulating inside information and other matters;

- the Company will no longer be required to publicly disclose any change in major shareholdings in the Company;

- Allenby Capital will cease to be nominated adviser and joint broker to the Company for the purposes of the AIM Rules;

- UK stamp duty may be due on transfers of shares and agreements to transfer shares unless a relevant exemption or relief applies to a particular transfer; and

- the Cancellation may have personal taxation consequences for Stockholders. Stockholders who are in any doubt about their tax position should consult their own professional independent tax adviser.

The above considerations are not exhaustive, and Stockholders should seek their own independent advice when assessing the likely impact of the Cancellation on them.

4. Transactions in the Common Shares prior to and post Cancellation

Prior to the Cancellation

Stockholders should note that they are able to continue trading in the Common Shares on AIM up to the date of Cancellation. If the requisite Stockholders approve the Cancellation Resolution at the Special Meeting, it is anticipated that the last day of dealings in the Common Shares on AIM will be 28 May 2025. The Board is not making any recommendation as to whether or not Stockholders should buy or sell their Common Shares.

Dealing and settlement arrangements post the Cancellation

In the event that the Cancellation becomes effective, there will be no market facility for dealing in the Common Shares and no price will be publicly quoted for Common Shares as from close of business on 28 May 2025, assuming that the Cancellation Resolution is approved. As such, interests in Common Shares are unlikely thereafter to be readily capable of sale and where a buyer is identified, it may be difficult to place a fair value on any such sale and such sale will require that an exemption from registration of the Common Shares is available under US securities laws. While there can be no guarantee that Stockholders will be able to sell any Common Shares, any Stockholder seeking to do so following the Cancellation should contact the Company in writing by post to the UK registered office of the Company, Heywood House, Westbury, BA13 4NA or by email to: investors@lunglifeai.com. Subject, inter alia, to the trade restrictions imposed by US securities laws, the Company will then be able to advise as to whether the Directors are aware of any prospective buyers for any Common Shares which the holder thereof wishes to sell at that time. It is emphasised that there can be no guarantee that Stockholders will be able to buy or sell Common Shares via the mechanism described above and given that there will be no market facility platform in place after Cancellation, Stockholders should therefore be aware of the risks of remaining Stockholders of LungLife following Cancellation.

If Stockholders wish to buy or sell Common Shares on AIM they must do so prior to the Cancellation becoming effective. As noted above, in the event that Stockholders approve the Cancellation, it is anticipated that the last day of dealings in the Common Shares on AIM will be 28 May 2025 and that the effective date of the Cancellation will be 29 May 2025.

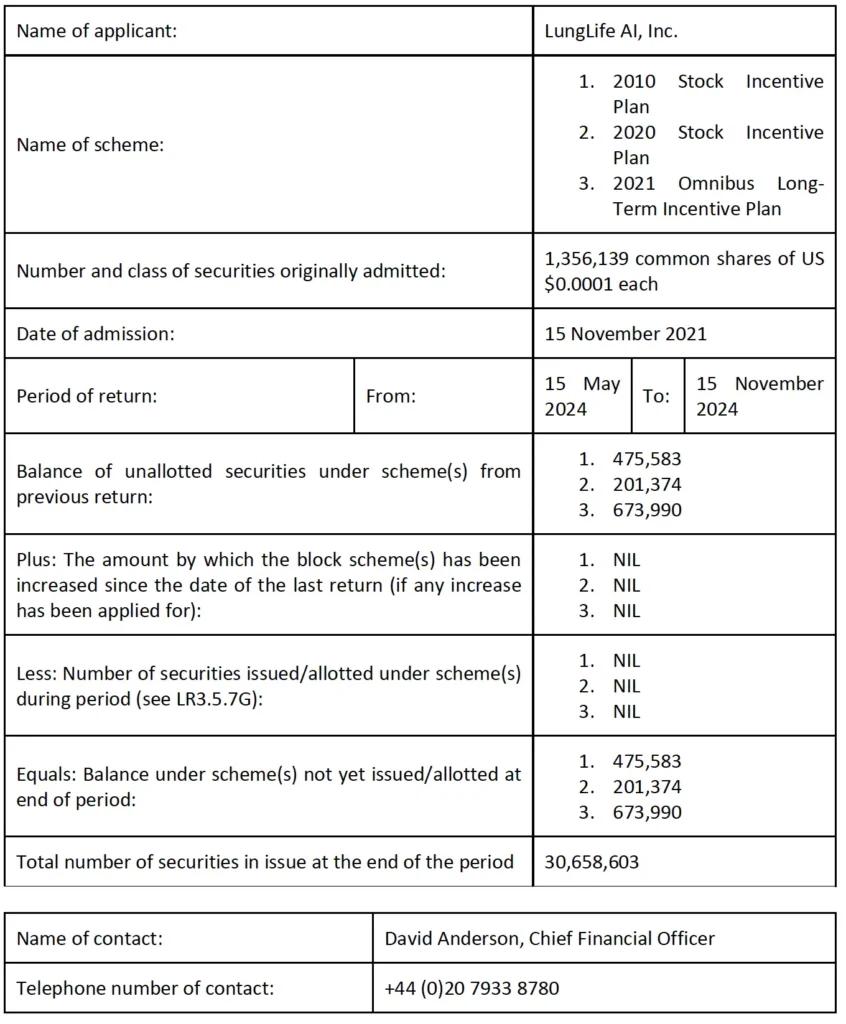

5. Options

The rights of certain individuals who hold options over Common Shares will be unaffected by the proposed Cancellation.

6. Special Meeting

The notice convening the Special Meeting to be held at the offices of Allenby Capital Limited, 5 St Helen’s Place, London EC3A 6AB at 4:00 p.m. UK time on 20 May 2025 is set out at the end of this Document.

- Resolution 1 to be proposed at the Special Meeting is the Cancellation Resolution to approve the Cancellation (conditional, pursuant to Rule 41 of the AIM Rules, upon the approval of not less than 75 per cent. of the votes cast, whether by Stockholders present in person or by proxy) at the Special Meeting).

- Resolution 2 to be proposed at the Special Meeting is the Agreement Approval Resolution and is a general resolution to approve the Agreement (conditional upon the approval of the holders of a majority of the outstanding common stock).

7. Action to be taken

Holders of Share Certificates

A Form of Proxy for use at the Special Meeting is enclosed.

Whether or not you intend to attend the Special Meeting, you are requested to return the Form of Proxy duly completed to the Company's registrars, MUFG Corporate Markets at PXS 1, Central Square, 29 Wellington Street, Leeds, LS1 4DL as soon as possible and in any event, so as to be valid, to arrive by 4:00 p.m. on 16 May 2025. As an alternative to completing the hard-copy Proxy Form, Stockholders can also vote via the Investor Centre app or web browser at https://uk.investorcentre.mpms.mufg.com/. Submission of the Proxy vote does not affect your ability to attend the Special Meeting and vote in person, if you wish.

Holders of Depositary Interests

A Form of Direction for use at the Special Meeting is enclosed.

By completing the enclosed Form of Direction, holders of Depositary Interests can instruct the Depositary to vote on their behalf at the Special Meeting, either in person or by proxy. If the Form of Direction is completed without any indications as to how the Depositary should vote, the Depositary Interest holder will be deemed as instructing the Depositary to abstain from voting. If the Depositary Interest holder wishes to instruct the Depositary (other than electronically using CREST or Proxymity), it must lodge the completed Form of Direction with the Depositary at the address stated on the Form of Direction during normal business hours no later than 4:00 p.m. on 15 May 2025.

Alternatively, Depositary Interest holders may instruct the Depositary how to vote by utilising the CREST electronic voting service. To instruct the Depositary how to vote or amend an instruction to vote via the CREST system, the CREST message must be received by the Depositary (CREST ID RA10) no later than 4:00 p.m. on 15 May 2025. For this purpose, the time of receipt will be taken to be the time (as determined by the timestamp applied to the message by the CREST Applications Host) from which the Company's Agent is able to retrieve the message. CREST Personal Members or other CREST sponsored members, and those CREST Members who have appointed a voting service provider, should contact their CREST sponsor or voting service provider for assistance. For further information on CREST procedures, limitations and system timings please refer to the CREST Manual.

If you are an institutional investor you may also be able to submit an instruction electronically via the Proxymity platform, a process which has been agreed by the Company and approved by the Registrar. For further information regarding Proxymity, please go to www.proxymity.io. Your instruction must be lodged by 4:00 p.m. on 15 May 2025 in order to be considered valid or, if the meeting is adjourned, by the time which is 72 hours before the time of the adjourned meeting. Before you can submit an instruction via this process you will need to have agreed to Proxymity’s associated terms and conditions. It is important that you read these carefully as you will be bound by them and they will govern the electronic submission of your instruction. An electronic instruction submitted via the Proxymity platform may be revoked completely by sending an authenticated message via the platform instructing the removal of your submission.

8. Recommendation, irrevocable undertakings and letters of intent

The Board believes that both of the Resolutions are in the best interests of the Company and its Stockholders as a whole and unanimously recommends you to vote in favour of them, as the Directors intend to do in respect of their own beneficial shareholdings, which in aggregate represent 0.39% of the Common Shares currently in issue.

Yours faithfully,

Gordon Roy Davis

Chair

APPENDIX 2: EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2025

| Announcement of the proposed Cancellation and approval to enter into the Exclusive License and Distribution Agreement with Circulogene Theranostics, Inc. | 29 April |

| Publication and posting of this Document and the Form of Proxy | 29 April |

| Latest time for receipt of proxy appointments in respect of the Special Meeting | 4:00 p.m. on 16 May |

| Special Meeting | 4:00 p.m. on 20 May |

| Announcement of result of Special Meeting | 20 May |

| Expected last day of dealings in Common Shares on AIM | 28 May |

| Expected time and date of Cancellation | 7:00 a.m. on 29 May |

Notes:

1. Each of the times and dates above is indicative only and is subject to change. If any of the above times and/or dates change, the revised times and/or dates will be notified by the Company to Stockholders by announcement through a Regulatory Information Service.

2. All of the above and below times refer to London time unless otherwise stated.

3. The timetable above assumes that the Resolutions set out in the Notice of Special Meeting will be passed.

4. Events listed in the above timetable following the Special Meeting are conditional on the Resolutions being passed at the Special Meeting without amendment.

APPENDIX 3: DEFINITIONS

The following definitions apply throughout this Document (including the Notice of Special Meeting) and the Form of Proxy unless the context requires otherwise:

:

| “Advanced Payment” | Under the Agreement, an advanced payment of $375,000 will shortly be paid to LungLife by Circulogene following signing of the Agreement |

| "AIM" | the market of that name operated by the London Stock Exchange |

| "AIM Rules" | the AIM Rules for Companies published by the London Stock Exchange from time to time |

| “Allenby Capital” | Allenby Capital Limited, the Company’s nominated adviser and joint broker pursuant to the AIM Rules |

| “Agreement” | the Exclusive License and Distribution Agreement between the Company and Circulogene Theranostics, Inc, as described in section 2 of Part I of this Document |

| “Agreement Approval Resolution” | Resolution 2 set out in the Notice of Special Meeting, to obtain Stockholder approval to approve the Agreement, which is required, among other things, for the Completion of the Agreement |

| “Asset Purchase Option” | the Agreement’s asset purchase option, as described in ‘Asset Purchase Option Terms’ in section 2 of Part I of this Document |

| "Business Days" | Any day upon which the London Stock Exchange is open for business |

| "Bylaws" | the bylaws of the Company, as amended and restated from time to time |

| “Cancellation” | the cancellation of admission of the Common Shares to trading on AIM in accordance with Rule 41 of the AIM Rules, subject to passing of the Cancellation Resolution |

| “Cancellation Resolution” | Resolution 1 set out in the Notice of Special Meeting, to approve the cancellation of the admission to trading on AIM of the Common Shares in accordance with Rule 41 of the AIM Rules for Companies |

| “Circulogene” | Circulogene Theranostics, Inc., a US liquid biopsy diagnostics company |

| "Common Shares" or "Shares" | shares of common stock of the Company with a par value per share of $0.0001 per share |

| "Company" or "LungLife" | LungLife AI, Inc. a company incorporated in the State of Delaware, United States and having its registered office at 850 New Burton Road, Suite 201, Dover, Delaware 19904 |

| "CREST" | the electronic systems for the holding and transfer of shares in dematerialised form operated by Euroclear UK & International Limited |

| "Depositary" | MUFG Corporate Markets Trustees (Nominees) Limited, Central Square, 29 Wellington Street, Leeds, LS1 4DL |

| "Depositary Interests" or "DIs" | dematerialised depositary interests representing underlying Common Shares that can be settled electronically through and held in CREST, as issued by the Depositary or its nominees who hold the underlying securities on trust |

| "Directors" or "Board" | the directors of the Company whose names appear on page 8 of this Document and "Director" shall mean any one of them |

| “Disclosure Guidance and Transparency Rules” | the disclosure rules and transparency rules made by the UK Financial Conduct Authority pursuant to section 73A of the Financial Services and Markets Act 2000 |

| "Existing Common Shares" | the 30,658,603 Common Shares in issue as of the date of this Document |

| "FCA" | the Financial Conduct Authority of the United Kingdom |

| “February 2025 Update” | the operational and funding update announced by the Company on 3 February 2025 |

| "Form of Direction" | the enclosed Form of Direction for use by Stockholders who hold Depositary Interests in connection with the Special Meeting |

| "Form of Proxy" | the enclosed Form of Proxy for use by Stockholders who hold share certificates in connection with the Special Meeting |

| "FSMA" | the Financial Services and Markets Act 2000 of the United Kingdom |

| "Goodbody" | Goodbody Stockbrokers UC, a company incorporated in Ireland with registered number 54223 and having its registered office at Ballsbridge Park, Ballsbridge, Dublin 4, D04 YW83 Ireland |

| "London Stock Exchange" | London Stock Exchange group plc |

| "Notice" or "Notice of Special Meeting" | the notice of the Special Meeting set out on page 14 of this Document |

| “Promissory Note” | a promissory note provided by LungLife that is secured by certain of LungLife's physical assets, as described in ‘Promissory Note’ in section 2 of Part I of this Document |

| “Required Consents” | the required consents to allow for Completion of the Agreement, including but not limited to, obtaining Stockholder approval and obtaining certain other consents under the Agreement |

| "Resolutions" | the Resolutions 1 and 2 to be proposed at the Special Meeting as set out in the Notice of Special Meeting, being the Cancellation Resolution and the Agreement Approval Resolution respectively |

| "Stockholder" | a holder of Common Shares |

| “Special Meeting” | The special meeting of the Company to be held at the offices of Allenby Capital Limited, 5 St Helen’s Place, London EC3A 6AB at 4.00 p.m. on 20 May 2025 |

| "UK" | the United Kingdom of Great Britain and Northern Ireland |

| "UK MAR" | Regulation (EU) (No 596/2014) of the European Parliament and of the Council of 16 April 2014 on market abuse to the extent that it forms part of the domestic law of the United Kingdom including by virtue of the European Union (Withdrawal) Act 2018 (as amended from time to time) |

| "US", "USA" or "United States" | the United States of America, its territories and possessions, any State of the United States, and the District of Columbia |

| "£" and "p" | United Kingdom pounds and pence sterling respectively |

| "$" and "c" | United States dollars and cents respectively |